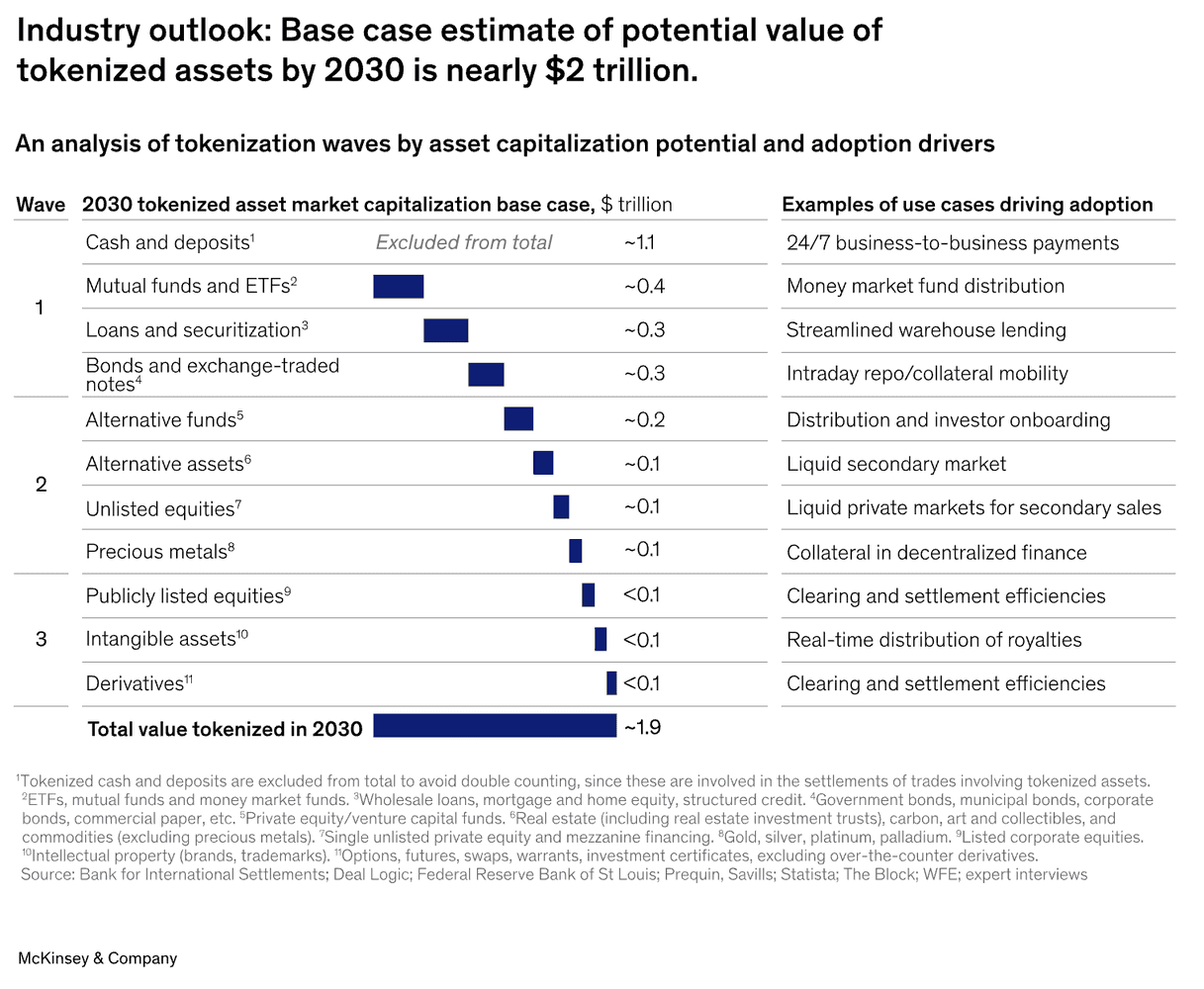

McKinsey estimates that the tokenized market capitalization across asset classes could reach about $2 trillion by 2030

"We estimate that the tokenized market capitalization across asset classes could reach about $2 trillion by 2030 (excluding cryptocurrencies and stablecoins)"

The article "From Ripples to Waves: The Transformational Power of Tokenizing Assets", written by McKinsey, dives into how tokenization is shaking up the financial world. Tokenization is the process of creating a digital version of an asset on a blockchain. This tech promises big benefits like increased efficiency, better liquidity, and more transparency. After years of experimentation, tokenization is now moving from small pilot projects to large-scale deployments.

Here's why it's a game-changer:

- Efficiency and Transparency: Tokens can reduce errors and streamline operations. For instance, the adoption of tokenized money market funds has hit over $1 billion in assets in early 2024.

- Liquidity and Access: It offers instant, 24/7 availability and makes global collateral mobility a reality.

- New Revenue Opportunities: Financial institutions can create new revenue streams through innovative use cases.

"We estimate that the tokenized market capitalization across asset classes could reach about $2 trillion by 2030 (excluding cryptocurrencies and stablecoins)"

Despite these perks, the road to widespread adoption is rocky. Challenges include modernizing existing infrastructure, regulatory hurdles, and the need for coordination across the value chain.

Key Takeaways:

- Adoption Waves: The adoption of tokenization is expected to happen in waves. Initial use cases with proven ROI will lead, followed by more complex asset classes.

- Market Size: By 2030, the tokenized market could reach around $2 trillion, potentially doubling to $4 trillion in a bullish scenario.

- First Movers: Early adopters can capture significant market share and operational efficiencies.

Examples of Current Adoption:

- Tokenized Bonds: Companies like Siemens and the World Bank are already issuing tokenized bonds.

- Tokenized Loans: Blockchain-based lending is on the rise, with disruptors like Centrifuge and Maple Finance leading the charge.

Tokenization has the potential to transform the financial services landscape, offering many benefits but also requiring substantial effort and collaboration to overcome existing challenges. Financial institutions that act now will be well-positioned to lead in this new digital era.