Navigating the Rules of New Token Listings on Kraken Crypto Exchange

Kraken, one of the most respected and established cryptocurrency exchanges

Kraken, one of the most respected and established cryptocurrency exchanges, is known for its rigorous listing standards and commitment to security and regulatory compliance. For blockchain projects, securing a listing on Kraken can significantly enhance visibility, liquidity, and market credibility. This comprehensive guide will explore the rules and criteria that Kraken follows when considering new token listings, providing insights into their process and requirements. Understanding these rules is essential for developers aiming to list their tokens and for investors seeking to gauge the quality of tokens on the platform.

Why Listing on Kraken Matters

Kraken's reputation for security, regulatory compliance, and a user-friendly interface makes it a sought-after platform for new token listings. Being listed on Kraken can offer projects substantial benefits, including access to a broad and active user base, increased trading volumes, and a seal of approval that can attract more investors.

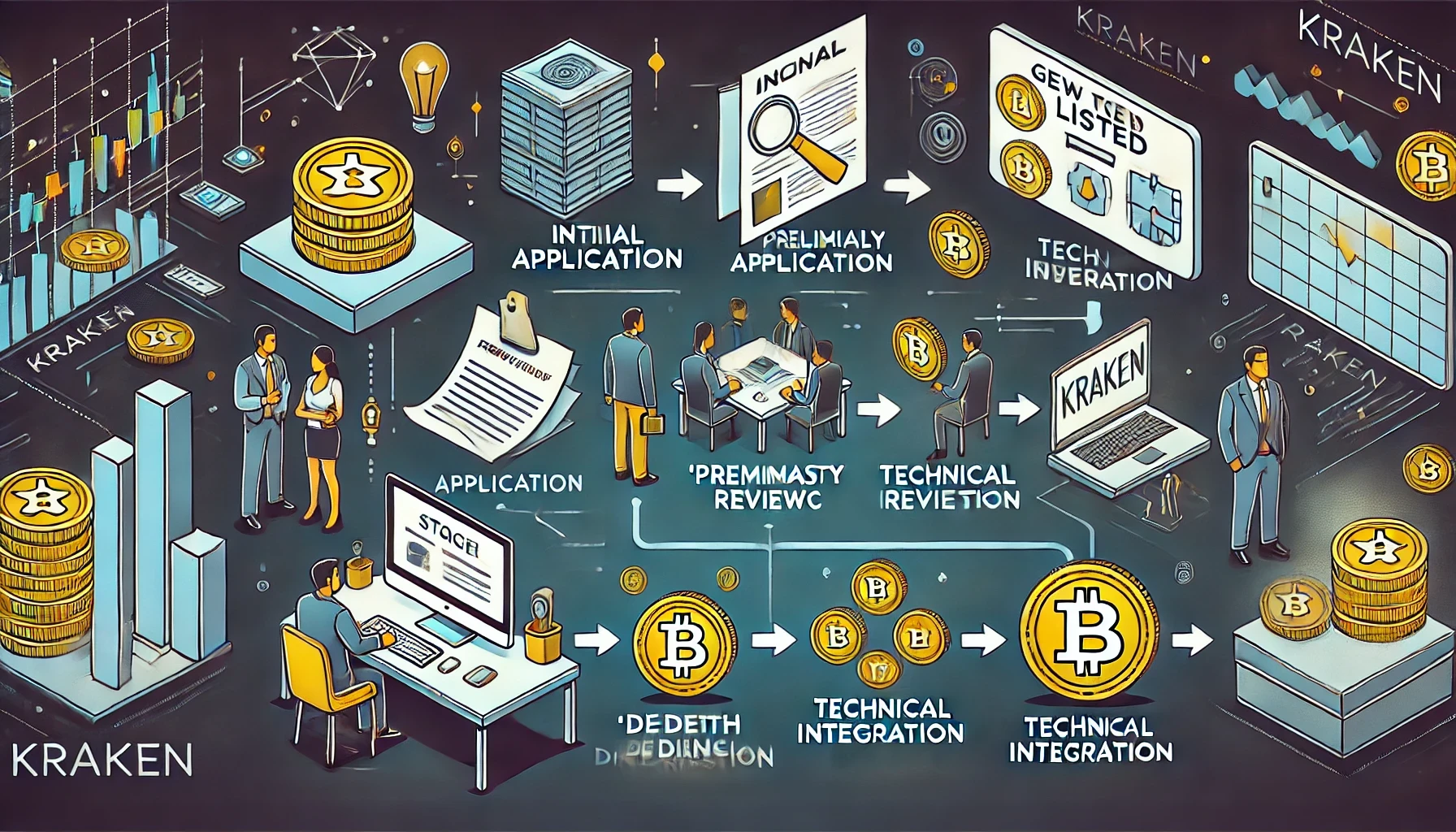

The Listing Application Process

1. Initial Application:

The first step in getting a token listed on Kraken is to submit a comprehensive application through Kraken's Listing Request Form. This form requires detailed information about the project, including the team, technology, tokenomics, and legal status.

2. Preliminary Review:

Kraken conducts a preliminary review of the application to assess the project's viability and potential. This initial review focuses on the project's compliance with Kraken's listing criteria, market demand, and overall contribution to the crypto ecosystem.

3. In-Depth Due Diligence:

Following the preliminary review, Kraken's due diligence team performs an exhaustive evaluation of the project. This includes a thorough examination of the project's legal compliance, security protocols, market potential, and the credibility of the team. The due diligence process ensures that only high-quality and compliant projects are considered for listing.

4. Technical Integration:

If the project passes the due diligence stage, Kraken's technical team will begin the process of integrating the token into their trading platform. This involves ensuring compatibility with Kraken's infrastructure and addressing any technical challenges that may arise.

5. Final Decision and Communication:

Once technical integration is complete, Kraken's executive team makes the final decision on whether to list the token. The project team is then informed of the decision, and if approved, Kraken will coordinate the official listing announcement and marketing efforts.

Key Criteria for Token Listings

Kraken has established a set of stringent criteria that projects must meet to be considered for listing. These criteria ensure that only the most promising and compliant projects make it onto the platform.

1. Regulatory Compliance:

Legal compliance is paramount at Kraken. Projects must adhere to all relevant laws and regulations in the jurisdictions they operate. This includes providing necessary legal documentation and demonstrating compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements. More details on Kraken's compliance can be found on their legal page.

2. Security Measures:

Kraken places a high emphasis on security. Projects must implement robust security measures, including regular security audits, code reviews, and strategies to mitigate potential vulnerabilities. The exchange's security team assesses these measures to ensure the protection of users' funds and data.

3. Team Expertise and Transparency:

A strong and transparent team is essential. Kraken looks for teams with a proven track record in the blockchain or related industries. Transparency about the identities, qualifications, and backgrounds of team members is critical for building trust.

4. Innovative Technology:

Kraken seeks projects that offer innovative and disruptive technology. This includes unique consensus mechanisms, advanced smart contract functionalities, or significant improvements over existing solutions. The technological innovation of the project is a key factor in the listing decision.

5. Market Demand and Liquidity:

Market demand is a crucial consideration. Kraken evaluates the trading volumes of the token on other exchanges, its liquidity, and the overall interest from the crypto community. Tokens with high market demand and strong liquidity are more likely to be listed.

6. Real-World Utility:

Projects should have clear and practical use cases. Kraken assesses the real-world applications of the token and its potential to drive adoption within and outside the crypto community. Tokens that address real-world problems and demonstrate practical utility have a better chance of being listed.

7. Community Engagement:

A vibrant and engaged community is a strong indicator of a project's potential for growth. Kraken considers the level of community support, social media activity, and overall sentiment surrounding the project.

Post-Listing Requirements

Once a token is listed on Kraken, the project team must adhere to certain ongoing requirements to maintain their listing. These requirements ensure the continued quality and compliance of the listed token.

1. Regular Reporting:

Project teams are expected to provide regular updates on their progress, including development milestones, partnerships, and community engagement. Transparent communication is key to maintaining investor confidence.

2. Ongoing Security Audits:

Continuous security audits and improvements are essential. Kraken may require periodic security assessments to ensure the project remains secure and resilient against potential threats.

3. Compliance Maintenance:

Ongoing compliance with legal and regulatory requirements is mandatory. Any changes in regulations or legal status must be promptly communicated to Kraken. This ensures that the project continues to meet Kraken's high standards for legal compliance.

4. Market Performance Monitoring:

Kraken monitors the market activity and overall health of the listed tokens. Consistent underperformance or negative developments could lead to delisting. Kraken ensures that only tokens with a strong market presence and positive trajectory remain listed.

The Importance of These Rules

The stringent rules and criteria set by Kraken for new token listings serve several critical purposes:

1. Investor Protection:

By thoroughly vetting projects, Kraken aims to protect investors from fraudulent or low-quality projects. This rigorous vetting process helps maintain trust in the exchange and the broader cryptocurrency market.

2. Quality Assurance:

The criteria ensure that only high-quality projects with real potential are listed. This not only benefits investors but also helps advance the overall blockchain and crypto ecosystem.

3. Market Stability:

By listing projects that comply with legal and regulatory standards, Kraken contributes to the stability and legitimacy of the cryptocurrency market. This fosters a sustainable and robust trading environment.

4. Innovation Encouragement:

Kraken's emphasis on technological innovation encourages the development of new and disruptive technologies. This drives the blockchain industry forward and promotes the creation of cutting-edge solutions.

Navigating the process of getting a new token listed on Kraken requires careful preparation and adherence to the exchange’s stringent criteria. For project developers, understanding these rules and meeting the necessary standards can open up significant opportunities for growth and recognition. For investors, these rules provide a level of assurance regarding the quality and potential of the tokens available on the platform.

In the fast-evolving world of cryptocurrencies, exchanges like Kraken play a crucial role in shaping the market landscape. By maintaining high standards for token listings, Kraken helps foster innovation, ensure security, and protect the interests of the broader crypto community.

For more detailed guidelines and updates on Kraken's listing process, you can visit their official support page and blog. This comprehensive understanding of Kraken's listing rules can significantly benefit both developers and investors, contributing to a more secure and vibrant cryptocurrency ecosystem.